What is SALT Lending?

On episode 72 of LAB Radio, we are joined by Rob Odell, VP Product and Marketing from SALT Lending to discuss what's new with SALT.

SALT is a lending platform that uses crypto as collateral. It's a simple yet brilliant platform to allow users to leverage their existing crypto portfolio to leverage against a fiat loan.

How does it work?

For example, you own 5 bitcoins and need $25K to put a new roof on your house. Let's assume 1 Bitcoin is valued at $10K and you believe Bitcoin will rise in value from $10K to $50K in the next 3 years. Instead of selling 2.5 BTC, you could leverage your 5 BTC at a 50% Loan To Value (LTC) ratio. You would receive a $25K interest only loan with minimal interest payments due monthly and the balance due in the last month of the loan.

Let's say Bitcoin never reaches $50K, but it does hit $25K at 24 months into the loan. In this scenario you could close out your loan by selling 1 BTC instead of the original 2.5 BTC you were going to have to sell.

On the flipside, if Bitcoin never goes up and actually drops to $5K, the value of Bitcoin you have locked up in collateral is now only worth $25K. When the loan was originated it was set up to maintain a 50% LTV ratio, the loan is currently at 100% LTV. This adds significant risk to the lender.

To correct the out of range LTV, 3 things can happen. You can add more bitcoin to the collateral to bring the loan back down to a 50% LTV. You can make a one time stablecoin payment or your collateral can start to be liquidated to cover your loan.

"SALT is not in the business of liquidating your crypto." -Rob Odell

The last part sounds scary, as it should. No one wants to lose their crypto, that's why they are taking a fiat loan in the first place. The pause that it gives to one's decision making should be noted. A loan is not free money. Crypto doesn't always go up.

However, if you find yourself in a situation needing cash, owning crypto and not wanting to part with it, SALT Lending is a possible killer solution.

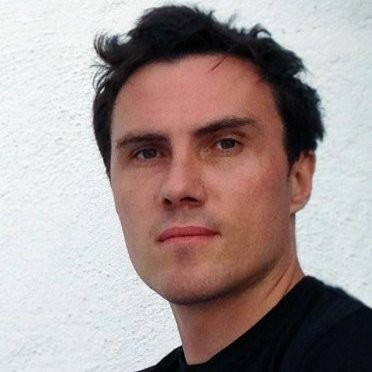

Meet Rob Odell. He's been with the company since 2017 and recently promoted to Vice President of Product and Marketing. Rob is very excited about the newest updates to the SALT Lending platform. The most significant of which include more business functionality and multiple users on business accounts.

SALT is originating more loans than ever. They actually have a lot of repeat customers. Since the terms of the loans range from 3-36 months, they have seen a lot of people take out test loans. They want to try a loan of a smaller amount before they get into a much higher leveraged position.

SALT has also worked very hard to bring insurance to their customers. There was a lot of basic education needed to make the insurance company feel comfortable with their processes. It took about 2 months and they had 2-4 office visits before they were given the insurance policy. "We wear it like a badge of honor," says Rob Odell.

How Rob found crypto

Rob's crypto journey begins in 2013 when he and his wife moved to Bali so she could pursue her dream as a SCUBA instructor. He became friends with some Ex-Pats and started going to meetups. At one meeting, he was introduced to a man who was purchasing local coffee from farmers, roasting it and selling it for bitcoin on the internet. Rob's curiosity was sparked.

Before moving to Bali, he previously taught English in South Korea. He met Mike Facchin of Search Scientists and began helping him build his Ads business remotely. This allowed him to gain insights into marketing campaign management and ultimately to where he is today.

During this episode, Rob Odell explains:

- How does SALT approach traditional financial products education?

- SALT's philosophy on product and process improvements?

- What crypto means in a relationship?

- His views on crypto adoption.

- What would he would change in the crypto and blockchain industry.

http://traffic.libsyn.com/labradio/Ep_71_Alex_Adelman_-_Lolli_mixdown.mp3

Further Reading and Resources

Rob Odell | LinkedIn | Twitter

What is Lolli?

More coverage from the Bitcoin2019 conference. This time with CEO and Co-Founder of Lolli, Alex Adelman.

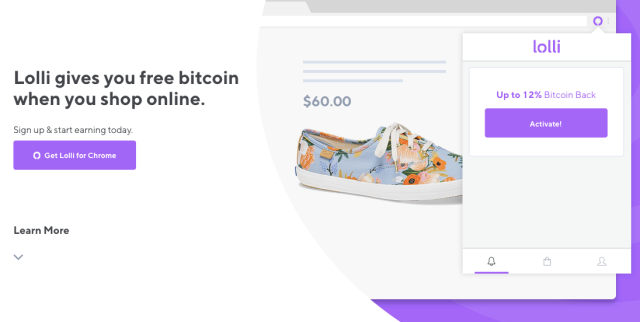

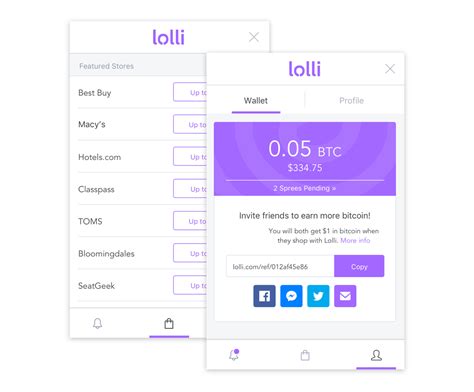

Lolli is a rewards app that pays you in Bitcoin. Purchase things as you normally would, but instead of proceeding to checkout, use the Lolli browser extension. This enables the user to earn a percentage back on their purchase, which can be redeemed in Bitcoin.

Lolli's goal is to onboard as many people into the Bitcoinsphere as possible. They believe most people are more likely to earn bitcoin rewards rather than bitcoin through investing or mining. Lolli just pops up when you're on a partner's website letting you know how much bitcoin you can earn. They want to make it as easy for possible.

How does it work?

The magic happens in the background. The retailer pays Lolli in dollars for sending paying customers to their site. Then Lolli transfers bitcoin to your Lolli Wallet. It is a custodial solution, but the amounts are usually so small that the user risk is limited.

"The biggest challenge Bitcoin has is educating people what money is." Alex Adelman

At first, Lolli plans only allow redemption of earnings. In the future, they plan to allow their users to purchase crypto through the Lolli platform. This will give them ability to also transfer funds to each other. Of course, Alex knows this path is very arduous, but is an important piece to their future success.

For 40% of all their users, Lolli is the only crypto brand they are connected to. This means they must add functionality for those users to keep them engaged. Eventually, you will be able to buy, sell and send your crypto to anyone within the Lolli ecosystem.

"If Bitcoin is the bank of the future, where's the lollipop at the end?" -Alex Adelman

Alex's background is quite fascinating. He grew up in Charlotte, North Carolina where his father was a psychologist turned banker. He saw first hand the issues with banks and financial institutions. In fact, that's where the name Lolli came from. In his younger days, he would have to go to the bank with his father. The only thing that helped with that dreadful experience for Alex was the lollipop at the end.

When he transitioned from developing for fun to doing it as a side business he ran into numerous issues. As you may expect, a 16 year old has trouble opening Bank accounts, Paypal or other payment channels. His curiosity led him to ask questions about why middlemen are needed and aren't there more efficient way to transact?

In college he studied economics, both micro and macro. This helped give him insight to his questions and build solutions.

His first venture after college was a company called Cosmic, a universal card as a service. It was a grandiose vision to allow people to transact with anyone, anywhere in the world. Alex felt a gateway like this was needed badly.

Cosmic was acquired by Pop Sugar to power ShopStyle. After growing 10X post acquisition, Ebates came in and bought both them and ShopStyle. Ebates is the largest cash back company in the US. That helped them form retailer relationships, which has sped up Lolli's on boarding.

During this time he had been learning about Bitcoin. After about a year with Ebates, he parted ways and decided he wanted to work in the crypto industry. He felt the solution in Bitcoin that hadn't been solved yet was distribution.

He knew with his background, determination to changing the world, and the timing of Bitcoin, he had hit the trifecta with Lolli.

During this episode, Alex Adelman explains:

- How he learned about Bitcoin from Ryan Shea.

- Where does Alex's motivation come from?

- What happens to user sentiment when price goes down?

- His pivotal moment about how the world was not a fair place.

- His views communication and commerce.

- What would he would change in the crypto and blockchain industry.

Further Reading and Resources

Alex Adelman | LinkedIn | Twitter

Lolli |Website | Twitter | LinkedIn

Chris Wittenborn, Business Development and Strategy at Velocity Markets

On episode 70 of LAB Radio, Velocity Markets’, Chris Wittenborn chats with your host Chris Groshong from Bitcoin2019.

Chris first heard about Bitcoin back in 2010. He read the whitepaper, but couldn’t get around the fact that he meet someone in parking lot to buy bitcoins. After growing up in Chicago, he moved to Colorado for better winters, great skiing and to pursue a degree at the University of Colorado Boulder. He landed a research job with a little finance firm locally and was given some sage advice to go East.

It was in 2011 when Chris headed to New York and where he really dug into the financial world. In 2017 there was lots of rumblings about the Institutional world coming into the crypto space. Being on the Institutional side, he knew that ecosystem was not ready to support Institutional grade customers. Therefore, he left to start providing institutional consulting for Exchanges and Private Equity companies building products.

“Shorthop is an institutional caliber exchange technology in the hands of the retail user”

-Chris Wittenborn

Velocity Markets is the parent company for Shorthop, an institutional caliber exchange technology in the hands of the retail user. Shorthop aggregates liquidity across several markets to provide its users the best possible price. The user no longer has to worry about which exchange to transact on or moving funds around. The user only has to focus on their desired outcomes, Shorthop does the rest.

They have different levels of services for different levels of clients based on their sophistication. They really focus on providing the user, whether its a Hedge Fund or an individual, with the best execution possible across a wide variety of exchanges. Initially, they are launching in California. Over the next several months, as they receive money transmission licenses, they will be opening up their platforms to other jurisdiction within the United States.

Recently, Chris Wittenborn has been spending his time working on leveraging their existing Broker/Dealer license to launch a digital securities exchange. This exchange would be separate from Shorthop and only be available to institutions and accredited investors. Creating a secondary market for compliant offerings is the future. The company Circle was recently able to achieve this, which is promising for Chris and the Velocity Markets team.

In this episode Chris Wittenborn discusses:

- Insight to the advice he was giving companies building for institutional clients

- Bitcoin Volatility and whether aggregating price will reduce volatility.

- Their efforts to launch a Finra registered digital securities asset exchange component.

- How he approaches is job and how he stays engaged.

- How he and his cofounders came together.

- What he would change about the industry.

Further Reading and Resources:

Chris Wittenborn, Business Development and Strategy at Velocity Markets | LinkedIn | Twitter | Email

Jan Čapek, Cofounder and Co-CEO at Braiins

On episode 69 of LAB Radio, Braiins Cofounder and Co-CEO, Jan Čapek chats with your host Chris Groshong from Bitcoin2019. We finally got a chance to sit down and talk mining after meeting in January 2019 in Las Vegas.

We first get a run down from Jan about the history of mining and what's wrong with the state of things currently. There's no surprise when it comes to understanding the mysteries behind ASIC Boost were just the tip of the iceberg. The problem is now mining has become so commercialized companies go to great lengths to keep firmware proprietary and access to making modifications difficult.

Braiins has decided to take a different approach. An open source approach. They feel if you can't audit or make changes to the miners at the root level then you really don't own them. This is why they have released Braiins OS.

"Not your firmware, not your miner." -Jan Čapek

The Braiins team motivation comes from their desire to have standards around mining. They spent a lot of time reengineering the software because they were tired inferior products being put onto the market. They even named their replacement of 'CGminer' with a symbolic cultural name, 'RURminer'. RUR comes from a 1920's sci-fi play from fellow countryman Karel Čapek about a future with robots.

By launching BraiinsOS, the goal is to maintain a repository that stays up to date and helps maintain stable version controls. This allows anyone to download a copy and get started building their own mining rigs.

It became obvious to Jan and his team that the level of customization and quality of products being offered were not ready for Enterprise scale. However, the businesses that were trying to operate at Enterprise levels were being thwarted by lack of control and data insights at every turn. This is why Braiins exists and has taken over as the parent company that oversees the development of the open source BraiinsOS and Slush Pool.

In this episode Jan Čapek shares with us:

- What is the current state of the Bitcoin mining scene?

- Why they choose the name 'RURminer' for their firmware.

- Why they choose to write their codebase in Rust.

- The ASIC chip makers and the Foundry chokepoint

- How attacks on mining pools are much easier to mitigate

Further Reading and Resources:

Jan Čapek, Co-CEO at Braiins | LinkedIn | Twitter

Braiins | Website | Twitter | Facebook | Linkedin | GitHub | Medium | Telegram | SlushPool

Xan Ditkoff, Growth at Blockstack

On episode 68 of LAB Radio, Blockstack's Head of Growth, Xan Ditkoff chats with your host Chris Groshong from Bitcoin2019. We discuss how great the conference was and what made it special.

Blockstack Xan, as I am respectfully dubbing him, has an interesting path that led him into the crypto world. Coming from New York to Silicon Valley in 2015 was a bit of an adjustment. However, he knew the solutions being worked on there were going to help impact more people globally than anything he could do in a world of suits. When he found the Crypto and Bitcoin Community in 2015 he knew this was the industry he was meant to be in.

"To me, decentralization is a means to an end." -Xan Ditkoff

His motivation stems from wanting to be a part of a transformative technology revolution. When he first learned about Bitcoin he knew how much it could solve and simplify the internet's hodgepodge of technologies with it's securities vulnerabilities and privacy issues. He views Bitcoin and Blockchain technology as a tool that helps people associate features, like opt-out privacy they are used to in the physical world instead of the opt-in privacy we experience in the digital world.

Having an understanding of how banking and US capital markets operate helped him connect the dots very quickly. Bringing things full circle, an energy and infrastructure project Xan worked on is adding bitcoin mining and hashing as a service for an additional revenue stream.

Blockstack is a decentralized computing platform and app ecosystem. They have a developer toolkit to allow apps built on Blockstack to require the use to give permission to access certain personal data. That personal data is controlled by each user and is never stored by a centralized service.

The origins of the project come from Princeton stemming back to 2013-14 and have passed through Y Combinator. When Xan joined they were just starting to onboard projects and over the course of the first year they learned a lot. Currently they have over 140 projects built or being built on Blockstack.

A large part for the increase in development is an incentive called App Mining. It rewards developers or teams that have used their technology from a pool of 100 thousand dollars. This is allowing people to test new value propositions or business fundamentals that may not have previously been achievable with current systems. They even audit the apps on their network to make sure they're not misaligned or inappropriately handling user data.

In this episode Xan Ditkoff shares with us:

- Why self sovereign identity is important?

- How Blockstack approaches its users identity security.

- A walkthrough of how to use the Blockstack platform

- What he would change about the industry

Xan is most excited about the Blockstack new smart contracting library more of which can be learned by checking out their new whitepaper. Their library will utilize Rust.

In a more perfect world Xan wishes for an increase of cross collaborative efforts.

The "Can't Be Evil" contest.

Further Reading and Resources:

Xan Ditkoff, Growth at Blockstack | LinkedIn | Twitter

Blockstack | Website | Twitter | Facebook | Linkedin | GitHub

Josie Bellini, Crypto Artist

On episode 67 of LAB Radio, Crypto Artist Josie Bellini chats with your host, Chris Groshong from Bitcoin2019.

Some might think the path is obvious for an artist and crypto lover. Create, Incorporate and Sell your works for crypto, but not Josie Bellini. Her passion for cryptocurrency and its ethos not only inspires her creative works, but also her innovative side.

Having a background in finance, specifically private wealth management, Josie invested personally in Ethereum and became interested more after its rise. After taking a full stack web development course at Northwestern University and doing design for a few blockchain and crypto companies, she knew she could contribute in very cool ways to the industry.

After one of her pieces went viral on Reddit, her arrival in the industry was cemented. Crypto Art was now her full time gig.

In this episode Josie Bellini shares with us:

- Which is her favorite piece?

- If her pieces are political or if they have special meaning to her?

- Why she uses Augmented Reality (AR)?

- What's new and coming down the pipeline for Josie's art?

- The intersection of Cryptocurrency and AR/VR tech adoption issues.

- How the addition of AR to her existing pieces has increased demand and keeps her collectors gushing.

- How NFT's are adding to her art repertoire while adding digital scarcity.

-"Filter out the Fiat, Breathe in the Truth" - Josie Bellini

Josie feels the relationships she's built through these online communities has been invaluable. She is humbled by the great support, interest and knowledge she has received from both the online and the physical world. As much as she loves the online community, the Twitter community that pushes negativity and the plethora of scam projects still marketing themselves well is dragging down the overall morale and needs a higher level of maturity.

All in all, Josie's involvement in the cryptocurrency and blockchain tech communities has helped open her mind to a totally different reality.

Further Reading and Resources:

Josie Bellini, Crypto Artist | LinkedIn | Twitter | Website

Download the Artivive app to view Josie's work in AR | Google Play | App Store

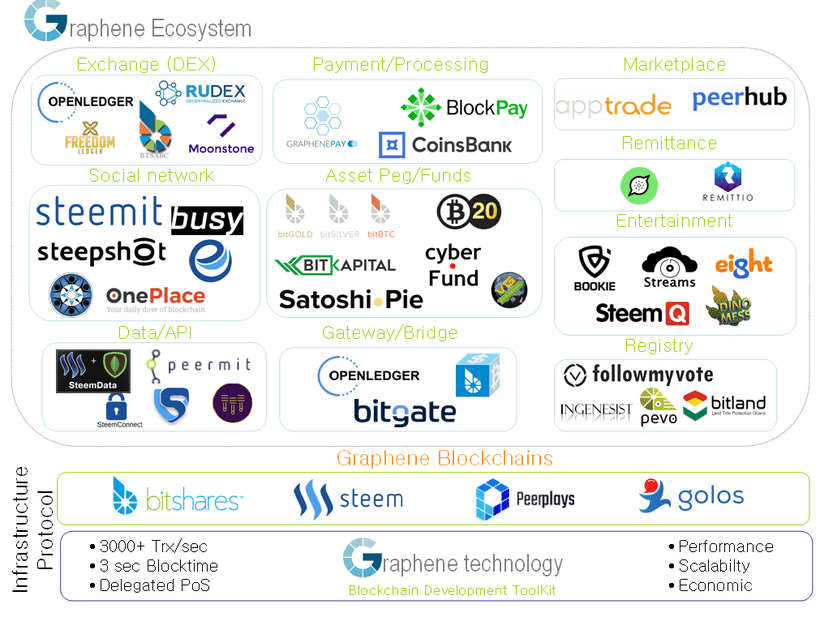

What is Graphene, BitShares and BEOS?

This is part 2 of a deep dive chat with Michael Taggart, BitShares . We discuss why they created BEOS and the practicality of creating a EOS clone.

Michael Taggart, co-founder of BEOS and Quintric

Michael is a long time BitShares supporter and recently helped co-found an EOS clone to act as a middle-chain between BitShares and EOS networks and tokens.

Quintric has tokenized real gold coins and legal tender

Quintric bridges Gold, Cash (Legal Tender), and Crypto

During this episode, you will learn:

- Why BEOS was created

- How the marketplace demands certainty such as the identity and location of Block Producers

- Why Utah was chosen as a venue for the BEOS Limited Cooperative Association (BCLA)

- How their legal team knows how to get policy accomplished and structure using pre-existing legal tender and

- How Terradac, a private enterprise that funded BEOS, interfaces with the BCLA

- How their operation and fund management system for the BCLA operates

- How they are moving toward trust-less gateway and counterparty settlements

- What Quintric is and why it is positioned as legal tender

- A just announced on this show $50 gold bill that Quintric is rolling out

What is Graphene? What is BitShares? And what else has been built on this framework?

This episode is a bit of an open long form chat and deep dive with BitShares regular Michael Taggart. This is the 1st of 2 parts for this episode.

Michael Taggart, co-founder of BEOS and Quintric

Michael is a long time BitShares supporter and recently helped co-found an EOS clone to act as a middle-chain between BitShares and EOS networks and tokens.

"BEOS Limited Cooperative Association (BLCA) is the world's first Non-Profit Cooperative Blockchain.

Designed as a middle chain, BEOS Blockchain allows interoperability between EOS/BEOS/BitShares based tokens.BEOS is a new privately funded blockchain, a straight clone of EOS intended to serve as a middle chain between BitShares and the EOS main chain. Its goals are token portability and jurisdictional agility. It does these functions without requiring any modifications to or cooperation from either BitShares or EOS communities, neither of which are involved in its development.

BEOS tokens serve the same functions as the EOS token on the EOS main chain - giving holders voting and access privileges to network resources.

BEOS seeks to develop a new kind of censorship resistance by designing the blockchain to be "intra-jurisdictional" (confined to one jurisdiction) and ultimately "jurisdictionally agile" (able to control which operations take place in explicitly designated jurisdictions). If token portability and jurisdictional agility are what you are looking for, then BEOS is the best alternative to the EOS blockchain."

During this episode, you will learn:

- How Michael got started in Bitcoin buyer around 2012

- How he become a liason between the business and technical side of companies

- A review of BitShares and what's happened to date

- How BEOS bridges BitShares and EOS as a middle chain

- Why it will leverage the "$3 Billion R&D Department" that is EOS to benefit BitShares

- How they are moving toward a trust-less gateway and counterparty system

- What excites and scares him the most about Crypto

For show notes and more visit: https://coinstructive.com/ep66-beos